The gold price in India has been grabbing headlines lately. For instance, 24-carat gold recently dropped to around 1,27,200 Rs per 10 g amid global profit booking and shifting demand.

💰 Live Gold & Silver Rate – India

Updated on: 06/12/2025

| Metal | Purity | Price / 10g (INR) |

|---|---|---|

| Gold | 22K | ₹1,19,300 |

| Gold | 24K | ₹1,32,130 |

| Silver | — | ₹1900 |

*Rates are updated manually every day based on local market trends.

Whether you’re buying jewellery for a festival, investing in gold bars or simply tracking your asset portfolio, knowing how gold price works, what affect it and how to time your purchase matters. In this article we’ll walk through all that: from current gold price in India, key influencing factors, trends, buying tips, and FAQs people are searching daily.

Current Gold Price in India & Recent Movement

Latest Prices for 24K, 22K, 18K

- For 24 K gold price in India is about 12,562 Rs per gram (per latest data).

- For 22 K gold the rate is around 11,515 Rs per gram.

- 18 K gold is approximately 9,422 Rs per gram.

These rate vary daily depending on city, purity, making charges, and taxes.

Recent Trend & Correction

After reaching near record highs, gold price in India have been correcting. For example:

- The 24 K rate dropped by around 3,380 per 10 g recently.

- One report noted a fall of over 4000 from peak levels.

- Global spot gold dropped 1.7% as of 22 Oct 2025 amid profit-booking.

Thus, while gold remains expensive, the recent dip offers perspective for buyers and investors.

What Determines the Gold Price in India?

Purity & Carat System

The first factor is the purity: 24 K (almost 100% gold) vs 22 K (~91.6% gold) vs 18 K lower purity. For instance, 24 K commands a higher rate due to higher gold content.

Also making charges, design, and hallmarking (purity certification) add to the final cost.

Global Gold Price, Dollar & Currency Movement

Gold is a global commodity. Changes in international spot gold price, and the strength/weakness of the US Dollar affect Indian gold rate. For instance, when the dollar weakens, gold often rises. Also, when the Indian Rupee weakens vs the dollar, imported gold become costlier, raising domestic rates.

Demand & Supply, Festival, Weddings

India has a big cultural demand for gold: festivals, wedding, gifts. This seasonal demand pushes up the gold rate. At the same time, supply side (imports, scrap gold, local mining- though minimal) plays a role.

When demand surges (For example before festivals like Diwali/Dhanteras) premiums over standard rate can increase.

Taxes, Import Duty & Policies

Import duties on gold, customs costs, taxes like GST and making charges affect final retail pricing. For example, GST applied on making charges or jewellery influences consumer cost.

Also institutional bodies set benchmark opening/closing rates-e.g., India Bullion & Jewellers Association (IBJA) publishes daily rates.

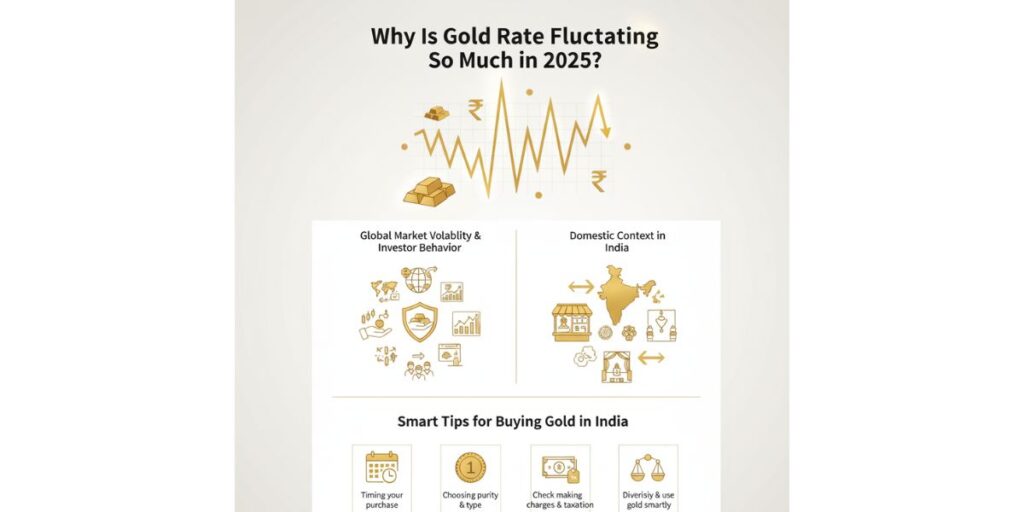

Why is Gold Rate Fluctuating So Much in 2025?

Global Market Volatility & Investor Behavior

In 2025 gold saw strong upside but also sharp corrections. For example, spot gold fell significantly due to profit booking after record highs.

Because gold is seen as a ”safe-haven”, when global economic concern rise, demand increase; when risk appetite returns, some profit taking happens.

Domestic Context in India

In India, despite high price, demand remains, but high prices may dampen jewellery demand while boosting investment demand (bars, coins).

Also, festivals/wedding seasons add spikes in demand, raising premiums above the ”spot” gold rate.

Currency depreciation, import costs and taxation all contribute to domestic rate volatility.

Smart Tips for Buying Gold in India

Timing Your Purchase

Watch for dips in price: When gold rate corrects after a rally (as in Oct 2025) it could be a better time to buy.

Align purchase with festivals or weddings but check whether the ”premium” (extra over spot) it too high.

Beware of chasing price highs- buying at peak without margin of safety may lead to disappointment.

Choosing Purity & Type

Decide whether you want 24K, 22K or 18K based on use (investment vs jewellery-wear)

For investment pure gold/bar/coins may be preferable; for jewellery durability and design matter (so 22K is common).

Verify hallmarking: the jewellery should carry the mark of quality/purity (see BIS hallmark rules)

Check Making Charges & Taxation

Shop around for best making charges; these vary by jeweller/design.

Ask what GST, local, premium above spot, and filing procedures are.

Consider other forms of gold investment (coin, bars, ETFs) if storage/maintenance of sell later)

Diversify & Use Gold Smartly

Treat gold as a part of a diversified portfolio (alongside equities, bonds).

For pure investment, keep transaction costs low (avoid overly fancy jewellery if you’ll sell later)

Maintain receipt, certificate, purity details, so resale is easier.

Frequently Asked Questions (FAQs)

What is the difference between 24K and 22K gold price in India?

24 K gold is about 99.9% pure gold; 22 K is ~91.6% pure with other metals alloyed. Thus, 24K will cost more per gram.

In daily rate table you’ll see separate listings for 24 K and 22 K.

How is the gold rate determined in India each day?

It’s influenced by international spot gold price, import cost (dollar/rupee ratio), demand-supply in India, taxes, duties, and local jewellery making charges. Also association like IBJA publish benchmark rates.

Should I buy gold now (2025) given current high rates?

If you view gold as a long-term hedge (inflation, currency risk), then buying during dips makes sense. If you are buying jewellery for occasion, you might wait for modest corrections or lower premiums. The current market is volatile, so timing is key.

Does buying gold guarantee profit?

No. Gold is less volatile than many assets but is still fluctuates. Price may rise or correct. Cost, making charges, resale value, purity, and demand all affect returns.

Which form of gold should i buy-jewellery or bars/coins?

For wear + decor, jewellery make sense through you’ll pay making charges/premium. For investment, bars/coins tend to have lower making charges and easier resale. Evaluate storage/security too.

How frequency do gold rates change in India?

Rates are updated daily (sometimes several times a day) depending on market conditions. Website list live rate for 24k/ 22K/ 18K.

Conclusion

The gold price in India remains one of the most closely watched economic indicators-culturally, financially and socially. While gold has long been a store of value and a symbol of security, in 2025 the interplay of global market shocks, currency fluctuations, heightened demand (festival/wedding) and investment behavior makes understanding this market more important than ever.

If you’re considering buying gold-whether for jewellery or investment- keep in mind: know the current rate, understand the factors at play, gauge the right time, compare purity/making charges, and avoid paying excessive premiums. This way you’ll make an informed decision rather then just buying based on tradition or hype.