Introduction of How to Save Money for Beginners

Saving money is something everyone wants to do, but many beginners feel unsure about how to start. The good news is that saving money is much easier than it looks. You do not need strict rules or big lifestyle changes – just small, easy habits that slowly build up over time.

Whether you are a student, a young professional, or someone who wants to manage money better, this guide will help you start your savings journey with confidence.

Why Saving Money Matters

Before you learning how to save money for beginners, It is important to know why saving is helpful. When you have some money saved, you feel safer and less worried. Even saving a small amount every month can give you stability and help you handle sudden expenses.

Here are some common reasons to save money;

- Emergency needs

- Education or learning new skills

- Buying a phone, laptop, or vehicle

- Travel plans

- Long term growth and investments

A recent survey found that 63% of people feel financial stress because they do not save regularly. This is why building good saving habits early is so important.

Step 1: Track Where Your Money Goes

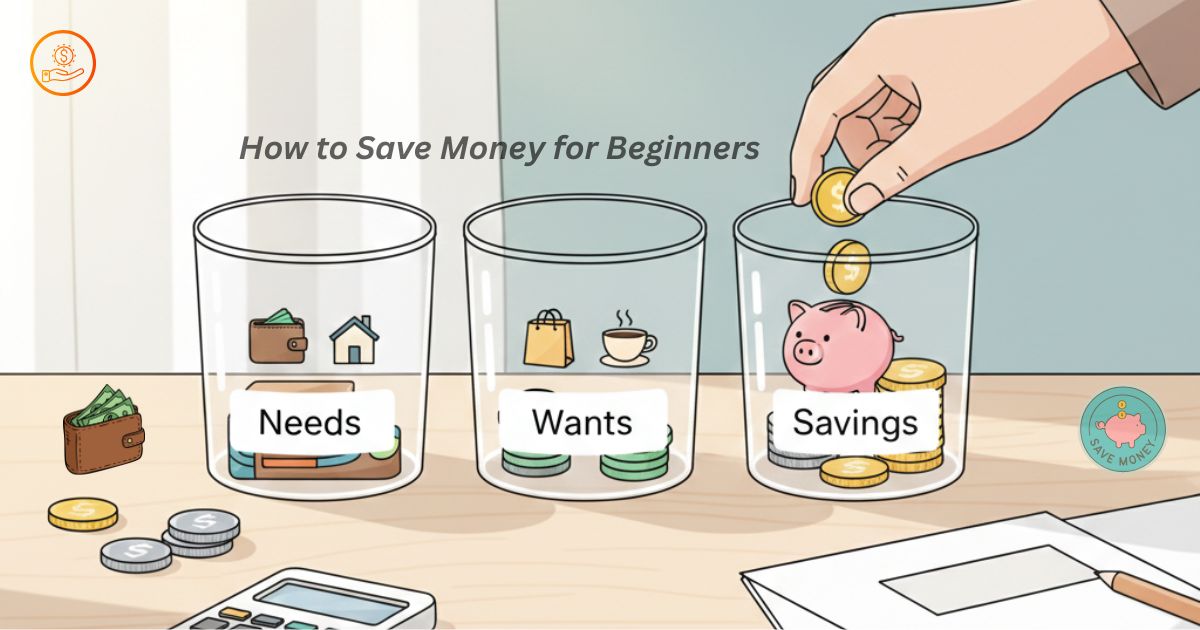

The first step in learning how to save money for beginners is understand how you spend it. Many people do not realize how much they spend on small things like snacks, subscriptions, or online shopping.

Try this simple method;

- Write down every expense for one week

- Divide them in to ”needs” and ”wants”

- Reduce or remove the things you do not really need

This small step can help you save money instantly without any hard effort.

Step 2: Create a Beginner Friendly Budget

Budgeting does not mean strict rules. It simply means giving your money a clear plan. Most beginners find this step very helpful.

Use the easy 50-30-20 rule;

50% Needs – food, bills, travel

30% Wants – movies, eating out, shopping

20% Saving – emergency fund, future goals

This rule is one of the easiest ways to follow how to save money for beginners without feeling pressured.

Step 3: Cut Small Costs That Add Up

You do not need to make big sacrifices. Start with small daily savings.

Easy ways to save;

- Make your own coffee instead of buying it

- Cancel subscriptions you do not you

- Choose recharge or data plans wisely

- Carry your own water bottle to avoid buying drinks

Saving just 50 – 100 Rs a day can turn into 1,500 – 3,000 Rs every month!

Step 4: Start an Emergency Fund

Every beginner learning how to save money for beginners should build a basic emergency fund. Even saving 500 – 1000 Rs per week can help you create a strong backup.

An emergency fund helps with;

- Medical needs

- Sudden travel

- Job delays or pay cuts

- Family emergencies

Try to save at least 3 months of basic expenses over time.

Step 5: Automate Your Savings

The easiest way to follow how to save money for beginners is to automate your savings. Set up an auto debit that sends a fixed amount to your saving account every month.

Automation helps because;

- You do not forget

- You avoid overspending

- Saving becomes a natural habit

Real World Example

Riya, a college student, used these simple steps. She checked her spending, reduced small daily costs, and saved around 1,500 Rs every month.

After 6 months, she created a 9000 Rs emergency fund without any stress. This shows how beginner friendly saving habits can make a big difference.

Conclusion: Small Steps Lead to Big Results

Learning how to save money for beginners does not required expert skills. It starts with simple awareness, a basic plan, and small daily habits. When you track your expenses, make a simple budget, and automate your savings, you slowly build confidence and financial security.

Start today- your future self will be grateful.

FAQs

Q1. What is the first step in saving money?

Start by tracking your daily expenses for at least one week. This helps you see where your money goes.

Q2. How much should beginners save each month?

Saving 10 – 20% of your income is a good and easy starting point.

Q3. Do I need a high salary to save money?

No. Small but regular saving are more powerful than saving big amounts once in a while.

Q4. What is an emergency fund?

An emergency fund is money kept aside for sudden needs like medical problems, job delays, or unexpected expenses.

Q5. Can beginners automate their savings?

Yes. Auto debit makes saving simple, automatic, and consistent.